Now that the 2024 presidential election has been declared, we have insight into the new administration’s policies and initiatives – and how they may impact your financial plan.

The Republican party won majority control of the White House, the Senate, and, at the time of writing, is leading in the House of Representatives, which will be important as President-elect Donald Trump looks to execute the policies and initiatives from the campaign trail.

Now, while we have some clarity on what to expect over the next four years, action takes time. It’s important to remain proactive and nimble when it comes to your own financial plan. Focusing on what you can control – long-term investment positioning, tax management, estate planning, budgeting, etc. – will allow you to react rationally and quickly when opportunities emerge. It is impossible to know the potential longer-term impact that different policies can have on the broader economy or market returns, which further highlights the need to apply a flexible, active approach within your financial plan.

As we provide insight into possible policy changes that will impact your plan, continue to seek guidance from your financial advisor on how these changes could affect your investments, estate planning, or tax situation. Now is a great time to develop a strategy that considers a full range of possibilities.

What’s the current and future tax climate?

A quickly approaching deadline for congressional action has many taxpayers feeling uncertain about the future and makes 2025 a crucial year for continued tax conversations and legislation. No matter what Congress decides over the next year, it is more important than ever to stay informed.

Our 2024 Tax & Wealth Planning Guide

Our complimentary guide covers everything from key facts and figures, to tips, tricks, and strategies to maximize your tax savings for the 2024 tax year. Download your copy and get the information you need to make this your most efficient tax year yet.

Download your free copyPresident-elect Donald Trump’s Tax Views

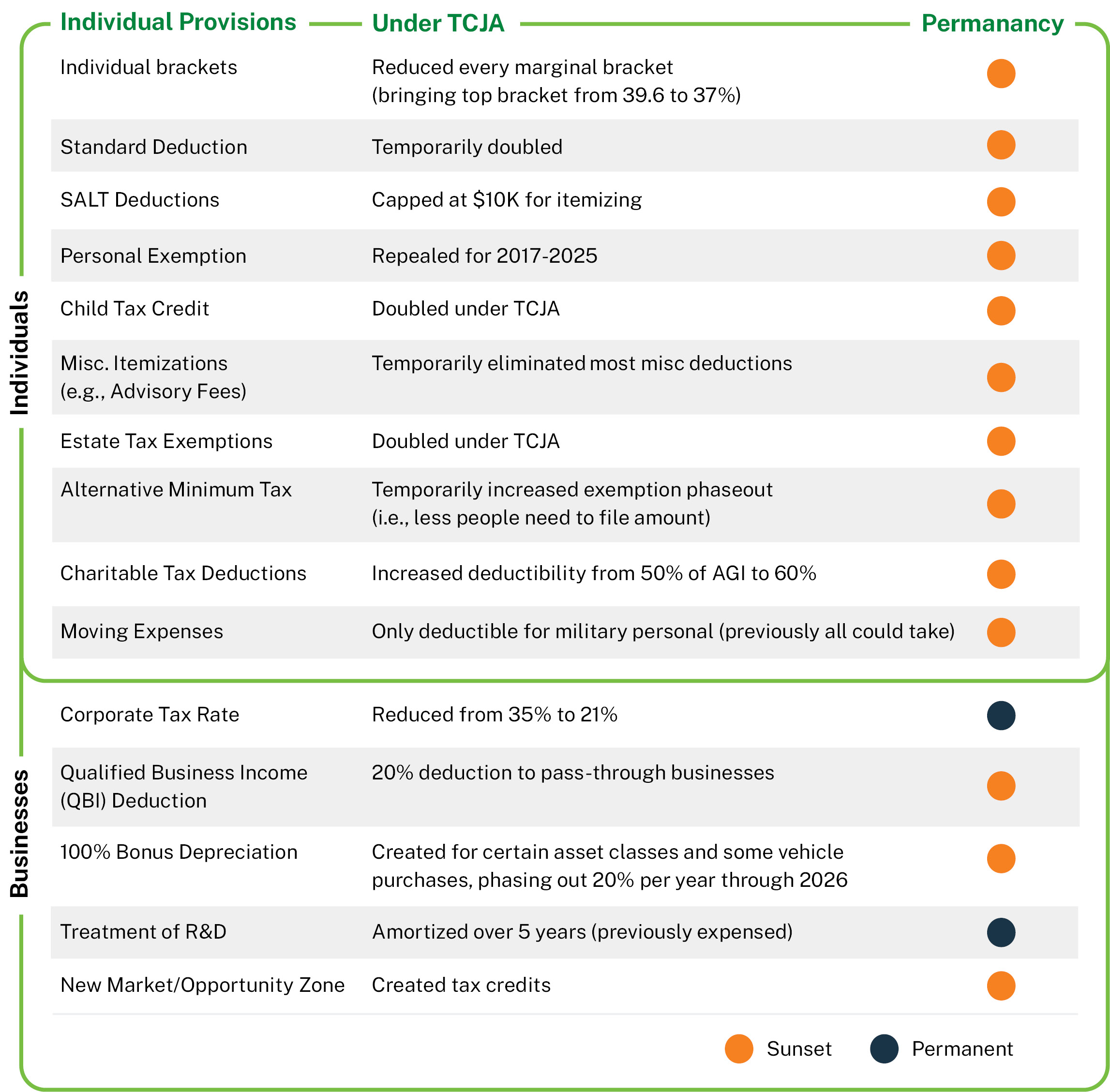

Tax policy is one of the most pressing issues for both individuals and businesses alike. The US tax landscape, shaped significantly by the 2017 Tax Cuts and Jobs Act (TCJA), is on the brink of major changes as many of its provisions are set to expire by the end of 2025. The tax proposals from the Trump administration are expected to play a critical role in shaping the future tax environment.

Trump’s tax policies are focused on extending the current low tax rates on individuals while expanding tax relief for businesses who produce domestically, which he argues, in addition to tariffs, will boost economic growth and keep jobs here in the United States. Although Trump has mentioned allowing the SALT cap on individuals to sunset, he has made it clear that he would aim to make the other expiring TCJA’s tax cuts permanent. In addition to extending the sunsetting TCJA provisions, other key components of his tax agenda include:

Tariffs in Lieu of Income Tax Hikes

One of the cornerstones of Trump’s plans to increase revenue outside of the income tax system is to implement tariffs on imported goods. Proposals include a 10%-20% tariff on imports from most countries and a 60% tariff on Chinese manufactured goods.

Lower Corporate Tax Rates

Trump’s administration has floated the idea of reducing the corporate tax rate even further, from the current 21% to 15% for companies that are producing domestic goods. This tax reduction is intended to incentivize businesses to expand domestic operations, creating new American manufacturing jobs.

Middle-Class Tax Cut

In his previous campaigns, Trump promised a 10% middle-class tax cut. Though this wasn’t achieved in his first term, it’s likely to reemerge as a key promise. In addition, Trump has introduced “No Tax on Tips” and “No Tax on Overtime” that will disproportionally benefit middle class citizens.

No Tax on Social Security

Trump has more recently committed to eliminating all tax on social security income. Currently it is estimated that about 50% of social security recipients are paying taxes on those benefits.

Even though it is great to consider that a favorable tax landscape is on the horizon, one of the principal areas of concern is how Trump plans to pay for the loss of revenue a TCJA extension would cause. When introduced in 2017, some Republicans believed that economic growth generated under the TCJA would result in a budget-neutral effect. However, according to the 2024-2034 outlook released by the Congressional Budget Office, extending the sunsetting provisions would result in a $4.6 trillion deficit that would need to be balanced out over the next 10 years. Trump has been vocal with criticism over extensive spending bills signed into law more recently and we could see a push to repeal clean energy credits, IRS funding, and American Care Act subsidies.

What does a Trump Administration Mean for the Tax Cuts and Jobs Act?

Due to the looming sunset of the TCJA, navigating this complex tax landscape is something that will be a major focal point of legislation ahead of the December 31, 2025 expiration date.

Without action from Congress, these expirations could lead to higher taxes for a wide range of Americans, from middle-class households to high-income earners. If allowed to sunset, an estimated 60% of American households could be facing higher tax liabilities in 2026.

Key changes included:

Although there is optimism that the TCJA will be extended, we’re encouraging individuals to continue engaging with their financial advisors to continue planning around current and potential rates and limits to best strategize and optimize your plan. Remember that new legislation takes time, and you don’t want to run into deadlines unprepared. We believe in the power of planning and a proactive approach that will keep you flexible to act accordingly, all while keeping your plan on track.

What should you do?

Engage with your financial advisor to…

- Create or review your financial plan.

- Stress test your plan against various scenarios to see how different environments and strategies will impact you reaching your goals.

- Discuss and identify estate planning, tax management, and investment strategies that align with your situation.

At this point, nothing is formal or guaranteed, yet the goal of planning is to be prepared – for both the expected and unexpected. Here at Manning & Napier, a key aspect of our role is to advise individuals on proposed or enacted tax policies by identifying key provisions that can impact investments and planning considerations. We work closely with individuals to build this information into our planning services to help clients understand and navigate the landscape to stay on track and focused on achieving their goals, and we’re here to help you, too.

We can help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. Start the conversation today by scheduling a call with a member of our team. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

Schedule a free consultation todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.