As you approach retirement, it's easy to find yourself in a game of "this or that" with your financial plan. Many factors and variables (unique to your situation) can lead you down one path or another. Timeless "rule-of-thumbs" might point you in the right direction, but instead of making it a guessing game, let's play "this or that" and hear how to best approach these common retirement planning questions.

On-Demand Webinar

Smart Retirement Strategies for High-Earning Professionals

Trading in your 9 to 5 for retirement takes strategic planning – especially during your final, high-earning years, which are crucial for building the savings you’ll rely on for decades to come. Watch now to discover smart retirement strategies and gain the confidence you need to step into your next chapter.

Watch nowThis or That: Retire early (mid-50s) or later (mid-60s).

When we think of retirement age, 65 most often comes to mind. It was the original full retirement age for Social Security, after all. Nonetheless, determining the right retirement age focuses less on your actual age and more on your cash inflows and outflows. In other words, when you can retire is determined mainly by what you want to spend throughout retirement. This is why having a rough but realistic idea of your future spending needs is so important. It's no secret that someone willing to live a modest lifestyle can retire much sooner than someone looking to live it up during their golden years.

In physics, something reaches "critical mass" when it has accumulated enough matter to become self-sustaining from an energy standpoint. In the context of financial planning, our job is to help you identify the moment your portfolio reaches "critical mass" and can confidently sustain the withdrawals you need to take to support the lifestyle you envision.

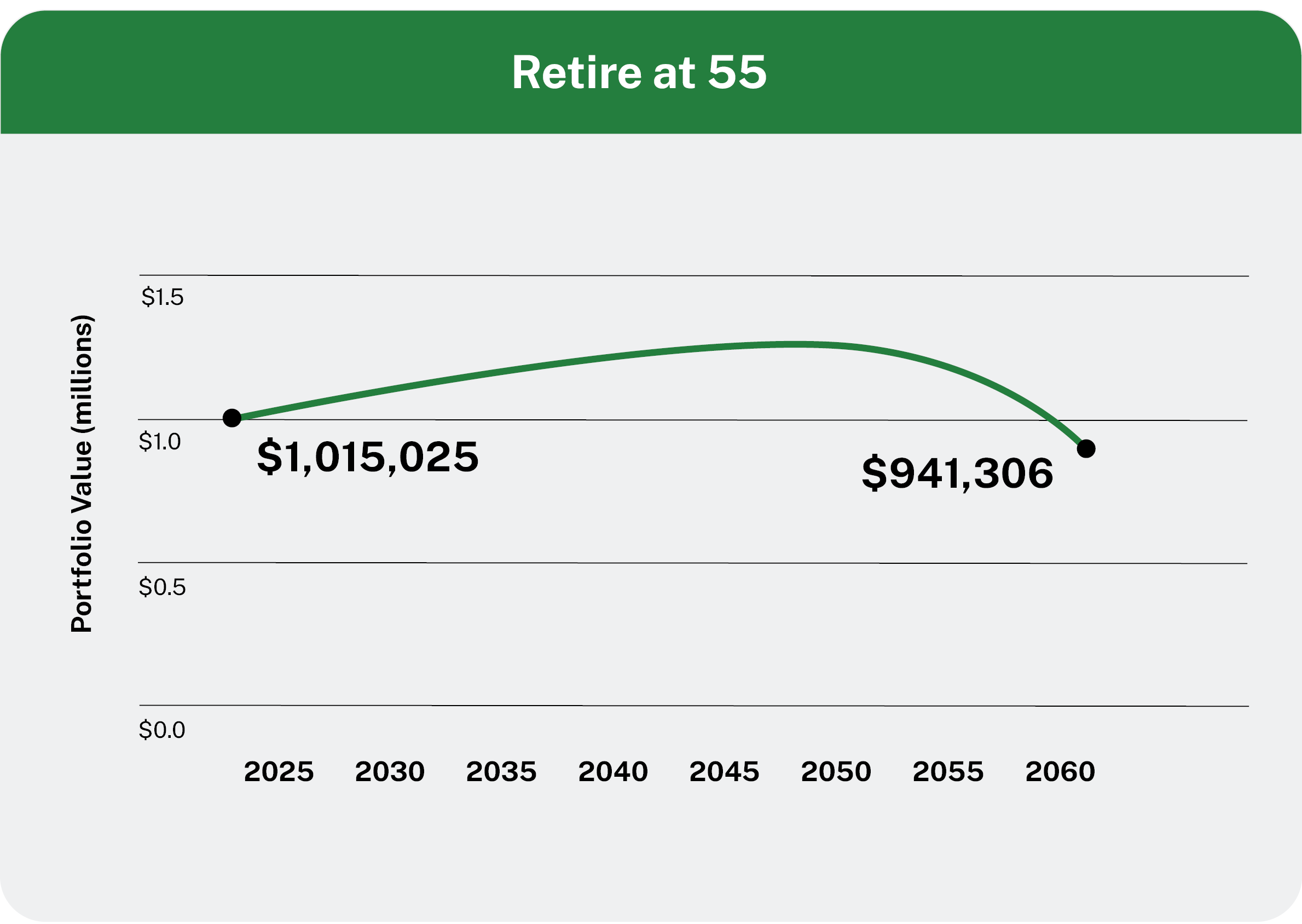

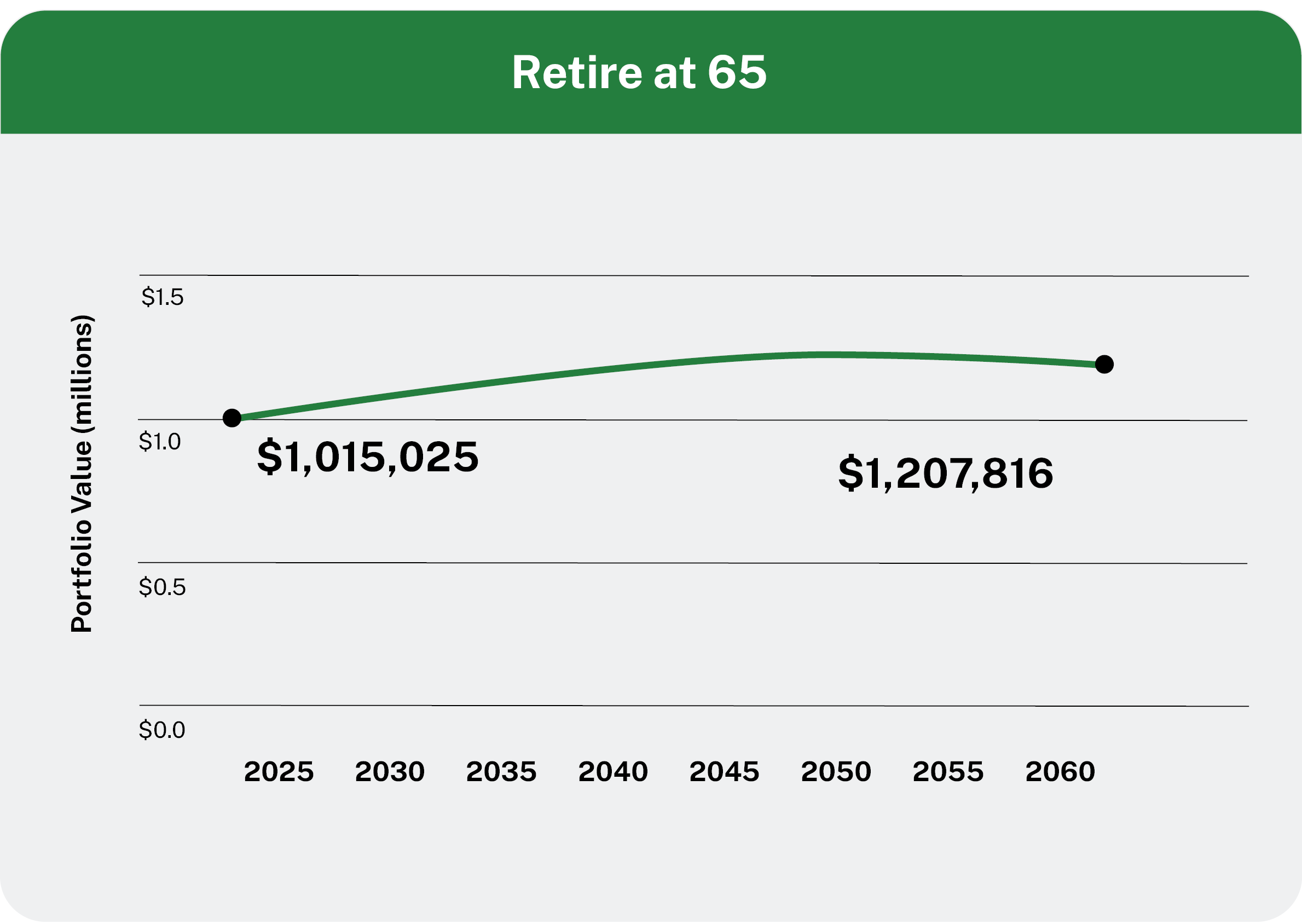

Let's look at a comparison to understand what we mean. The following illustrates an individual withdrawing $40,000 (after-tax and growing for inflation of 2.2%) from a portfolio with an initial value of $1,000,000 and growing at 6% per year. However, the first graph begins at age 55 and the second at age 65. Both graphs end at the individual's age of 92.

For illustrative purposes only.

Clearly, retirement is more than an age – both scenarios have a high probability of success and rely on reasonable spending assumptions that don't overpower the portfolio. If you increase spending by $10,000 annually, retiring at 55 might be unsound given the extended time horizon and higher withdrawal rate the portfolio would be expected to cover.

No retirement "rule" is set in stone. Your unique situation and vision for retirement both influence your decisions. It can also be a moving target because it is a function of many variables, like age, life expectancy, inflows, risk tolerance, and spending habits.

→ Takeaway: Start by defining your retirement goal (i.e., what you want to spend each year), and develop a plan to get your portfolio to its "critical mass" value. Find more pre-retirement planning tips and considerations here.

Retirement Planning Cheat Sheet

No matter what your retirement timeline is, planning early can help ease the transition. Our Retirement Cheat Sheet is full of helpful tips and to-dos to help you get started and ensure you’re on track to live the retirement you've been dreaming of.

Download the cheat sheetThis or That: Target a 4% withdrawal rate or dynamic withdrawal rate based on needs.

Targeting an initial withdrawal rate of 4%, often referred to as the 4% rule, was developed in the mid-1990s by financial planner Bill Bengen. Based on historical stock and bond returns from 1926 to 1976, his research suggested one could safely withdraw 4% of a balanced portfolio in the first year of retirement, adjust this initial amount by inflation every subsequent year, and have a high degree of confidence that the portfolio would last at least 30 years. The 4% rule is simple and provides a predictable income, but it doesn't account for changes in personal circumstances and spending patterns, which most everyone experiences throughout retirement.

On the other hand, a dynamic approach adjusts your withdrawals based on current market conditions and your remaining life expectancy, sometimes referred to as a "guardrails" approach. This approach can be more flexible and responsive to changes in your financial situation and the market. For example, if your portfolio performs well, you might withdraw more; if it performs poorly, you might withdraw less. It can also ensure your savings last longer but requires more monitoring and some comfort with making slight lifestyle changes during years of poor market returns.

→ Takeaway: Dynamic spending and lifestyles often require more flexibility in managing your portfolio and withdrawal rate, making ongoing monitoring essential.

This or That: Be more conservative or aggressive with your portfolio during your final working years.

Your ever-changing withdrawal rate, risk tolerance, and time horizon are the primary factors in the construction of your portfolio.

Sticking with our physics theme from above, imagine each dollar in your portfolio like an atom, the building blocks of your wealth. Like an investment, the more volatile an atom is, the more potential energy (or higher returns) it can produce, but it can also be more dangerous. When you are younger or have many years until the "use-by" date for each dollar in your portfolio, you can afford to take on more risk or volatility. You have many years to recoup any significant losses that may occur. By managing the risk or volatility of each dollar, the goal is to avoid withdrawing them at depressed values, which could permanently damage a portfolio. As we approach when we need to withdraw each dollar (or atom) from our portfolio, we want that specific dollar to be relatively stable.

In the context of your broader portfolio, the larger your initial withdrawal rate, the more conservative your portfolio may have to be. That transition from earning a paycheck to paying yourself can be difficult, and that is why it is so important to put a plan in place at least five years before retirement - not when you are about to pull the trigger. That way, your portfolio can align with your circumstances, especially if you're retiring early, well before Medicare or Social Security begins, which could put even more stress on your portfolio.

Stocks provide growth, with more risk of volatility, while bonds may offer a smoother ride but with a tradeoff of potentially less long-term growth. Depending on your situation, alternative asset classes could be an option to pursue as they can help diversify your portfolio, establish reliable income streams, and have higher return potential.

→ Takeaway: Stress testing your financial plan can help visualize how your portfolio will support your goals over the long term and identify areas for improvement that you can discuss with your financial advisor. Learn more about stress testing here, or get help stress testing your plan here.

This or That: Take Social Security sooner or plan to wait.

Deciding when to take Social Security is an important part of your financial journey, but many are unsure when the time is right. You may have heard the quip, "I can tell you exactly when to file for Social Security if you can tell me when you'll pass." Like many elements of financial planning, it is a decision based on probabilities and life expectancy.

The optimal claiming strategy varies based on an individual's financial situation and cash flow needs. Because everyone's situation is unique, we often recommend clients provide a copy of their most recent Social Security statement (access yours at ssa.gov). Using accurate data and looking at it from many angles can help visualize your wealth over time based on different filing ages. For example, someone in poor health and no other sources of income would benefit from claiming it early. In contrast, someone in excellent health with a robust family history might find it advantageous to delay.

→ Takeaway: Don't wait to plan for Social Security, especially if you plan to retire before the full retirement age (67).

Play this or that with your own plan

Test different scenarios on your own plan with our free financial planning app. Filled with a variety of tools, calculators, and educational modules, MyBlocks puts you in control of your financial future. Get your free access to this powerful, interactive tool today.

Get startedSimplifying Your Path to Retirement

Retirement is an important accomplishment, and it is not one that you should stumble your way into using internet hacks or "rules of thumb." Working with a trusted advisor throughout your final working years will instill confidence in your plan, as they will guide you through maximizing your retirement savings, creating a long-term financial plan, and understanding what is possible during retirement.

We can help

Planning for retirement should be fun! We can help guide you through the financial and emotional decisions that go hand-in-hand with retirement and create a personalized, comprehensive financial plan to help you get to your ideal retirement and includes elements like tax management, estate planning, charitable gifting strategies, investments, and more.

Get started with a free consultationPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.