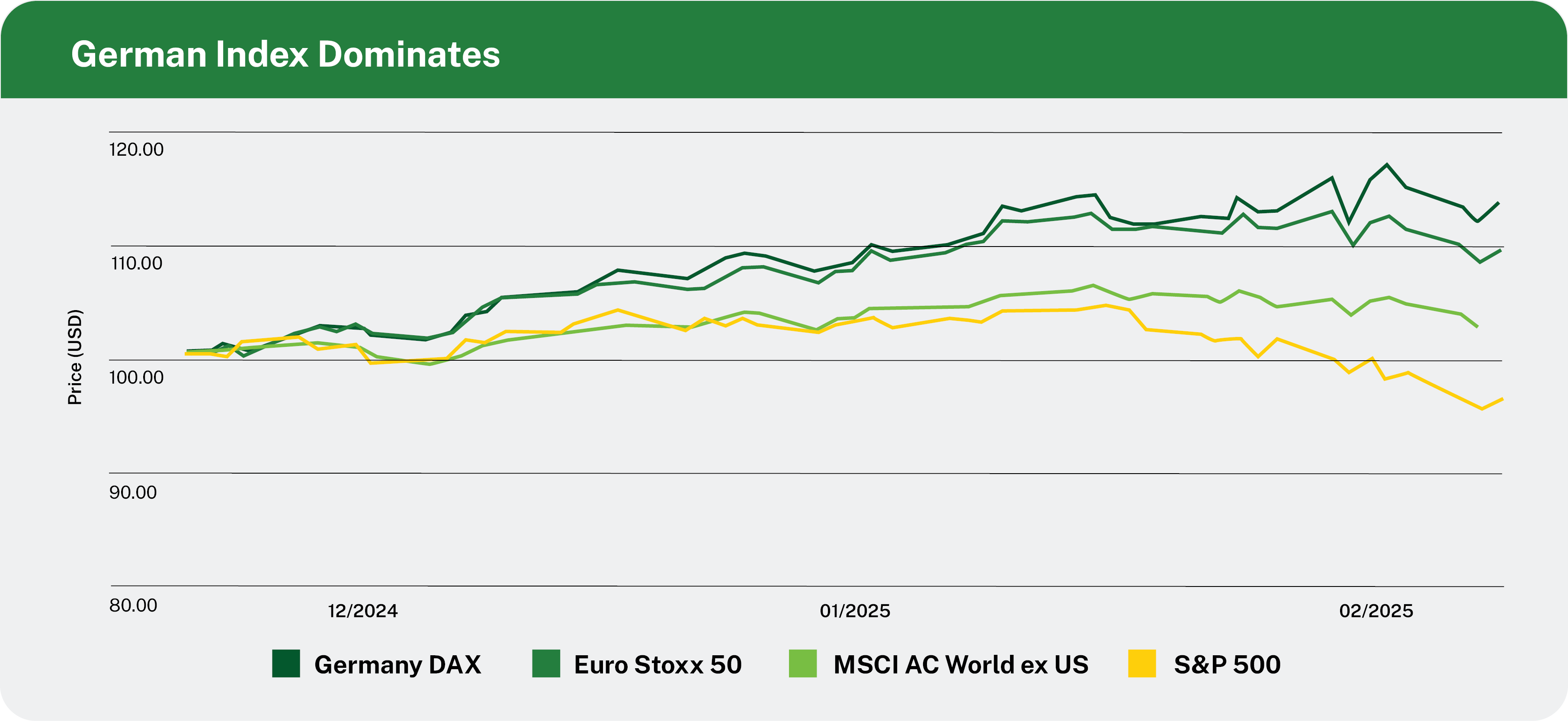

It's certainly been an interesting start to 2025, with global equities outpacing their domestic counterpart for the first time in a while. The story has not just been about relative performance, either. Many major ex-US markets have generated strong absolute returns even as US indices have fallen.

The German equity market has been among the strongest-performing equity markets to start the year (and even on a multi-year timeframe). The performance was mainly due to the market's leverage to foreign markets; the domestic German economy has seen slow growth for years, facing a combination of cyclical and structural challenges.

Analysis: Manning & Napier. Source: Bloomberg (12/31/2024-03/12/2025).

Those challenges have not gone unnoticed, though, with political changes in the US highlighting key issues.

On February 23rd, German voters went to the polls and elected a new government led by Friedrich Merz and the CDU/CSU Union parties. In response to the scale and immediacy of the country's challenges, policymakers quickly announced their intentions to move ahead with a €500bn infrastructure fund, and a plan to reform the country's constitutionally enshrined debt brake to allow for a meaningful increase in defense spending.

Reflecting both the significance of the challenges facing the country and the political reality of amending the constitution, policymakers are seeking to push these reforms ahead of the new government taking office. The current structure of parliament makes passing the constitutional reform more likely than it would be under the incoming government, which is seated on March 25th of this year. While there is currently pushback from a key partner, we anticipate that this is more about bargaining spending priorities than anything more significant. Whether before the new government is sat or not, we could expect an increase in spending and a reform to the debt brake to come to pass.

These changes would be significant for several reasons.

As it pertains directly to Germany, creating an infrastructure fund could provide a real boost to domestic GDP growth in the country that sorely needs it. The German economy is a bit over €4.2trn in size. Should the infrastructure package be rolled out over the next decade, you're looking at a sizable boost simply considering the headline number of €500bn in that timeframe. It's also important to remember that infrastructure spending has a multiplier effect, so the impact would be greater than the spending number alone.

The impact on defense spending is also likely to be real, reflected in German defense companies' stock prices. Many European countries have systemically failed to meet their spending commitments agreed under NATO, which has long been President Trump's sticking point. Recent actions by the US Administration have forced a rethink in Europeans' ability to rely on Americans for their common defense, and regional defense spending is almost certain to increase.

More broadly speaking, this type of spending package has the potential to be a catalyst in other European countries for directionally similar efforts. Germany has long been the fiscal hawk in the region. As such, this marks a very real departure from the old policies. It's possible to interpret this as a broader sea change. However, we'd caution against this. Because of their years of relative fiscal responsibility, Germany has a capacity to borrow that many other large European economies, such as France, simply don't. Germany is also in a unique political environment where parties seem able to come together to pass significant reform. This, again, is a far cry from the political backdrop in a country like France, where President Macron has a disapproval rating of close to 75% and will face calls for parliamentary elections this summer.

A final consideration is the potential impact on bond yields in the region. Following the announcement of the German reform package, German sovereign yields saw their largest one-day move since the fall of the Berlin Wall. While less stark, other European yields followed. The market is clearly concerned about increased spending and its impact on factors including the fiscal accounts of European countries, growth, and inflation. It will be interesting to see how durable the move in yields ends up being over time and if we see any reaction from the European Central Bank.

Germany is undoubtedly a country that has needed a catalyst for some time now. The country has been facing a series of structural and cyclical challenges. The incoming government has its hands full, but what we have seen in the brief time since the election has been a positive development. Given the direction of the US economy now and the valuations on the major equity indices, upside catalysts in Europe or elsewhere could provide investors with interesting options.

We should expect volatility moving forward, with markets swung by headlines ranging from political wrangling to negotiations on the war in Ukraine to tariffs. Still, we remain focused on looking globally for investment opportunities that meet our strict strategy and pricing disciplines.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

The DAX, or Deutscher Aktienindex, is a German blue-chip stock market index that tracks the performance of the 40 largest companies traded on the Frankfurt Stock Exchange, serving as a key benchmark for the German and European stock markets. Index returns provided by Bloomberg.

The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone. EURO STOXX 50 represents Eurozone blue-chip companies considered as leaders in their respective sectors. Index returns provided by Bloomberg.

The S&P 500 Price Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees, expenses, or adjust for cash dividends. Index returns provided by Bloomberg.

The MSCI ACWI ex USA Index (ACWIxUS) is designed to measure large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. The Index is denominated in U.S. dollars. Index returns are net of withholding taxes. They assume daily reinvestment of net dividends thus accounting for any applicable dividend taxation. Index returns provided by Bloomberg.

Index data referenced herein is the property of each index sponsor (MSCI and S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates ("S&P"), their affiliates ("Index Sponsors") and/or their third party suppliers and has been licensed for use by Manning & Napier. The Index Sponsors and their third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.