While it may seem like the 200ish days left in 2024 leaves plenty of time to procrastinate giving your finances the attention they deserve, it may not be as much time as you think. Sure, we’re all regularly budgeting and tackling the day-to-day to-dos, but life often gets busy, and we push proactive wealth management to the back burner.

And to be frank, this is not the year for that mindset. Now, we don’t mean to be dramatic and sound the alarm, yet there are several time-sensitive changes on the horizon that require planning and coordination between you and your professionals. To start, we’re highlighting the changes and providing the agenda for your next meeting with your financial advisor.

4 Financial Priorities for 2024

To Do 1: Create (or Update) Your Estate Plan

If you take nothing else away from this article, please make your estate plan a must-do by year-end. For two reasons:

- Everyone needs an estate plan.

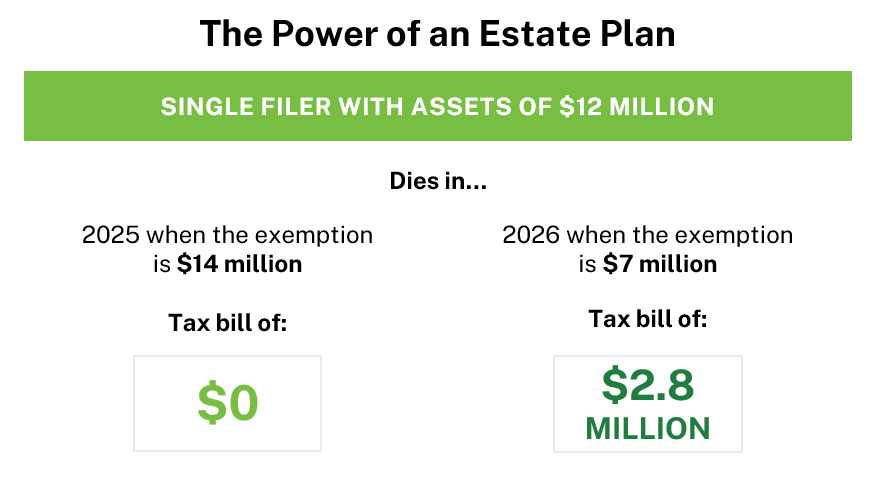

- There are legislative provisions (within the Tax Cuts and Jobs Act) sunsetting at the end of 2025. “Hold on. It’s only 2024.” We know. Planning takes time. Beginning in 2026 the per-person Federal estate and gift tax exemption is set to revert from somewhere around $14 million per person to somewhere around $7 million, making it advantageous to act now.

Therefore, everyone has some degree of estate planning to do. Those with sizable estates – greater than $40 million - should consider making substantial gifts before then. For those with smaller estates, it’s still strategic to explore annual gifting or techniques that remove assets from your estate while still providing access to assets like Spousal Lifetime Access Trusts (i.e., SLATs).

We can help you prepare for the Tax Cuts & Jobs Act sunset

Planning takes time and coordination. Don't leave money on the table as deadlines come and go, and schedules book up. Schedule a call with us today to review your existing plan, ensure you’re maximizing tax savings, and, most importantly, make sure you’re prepared for the deadline in 2025. No matter where your plan stands today, you’ll walk away with a roadmap of to-dos ahead of the sunset.

Schedule a call todayTo Do 2: Get Ahead on Your Tax Management and Planning

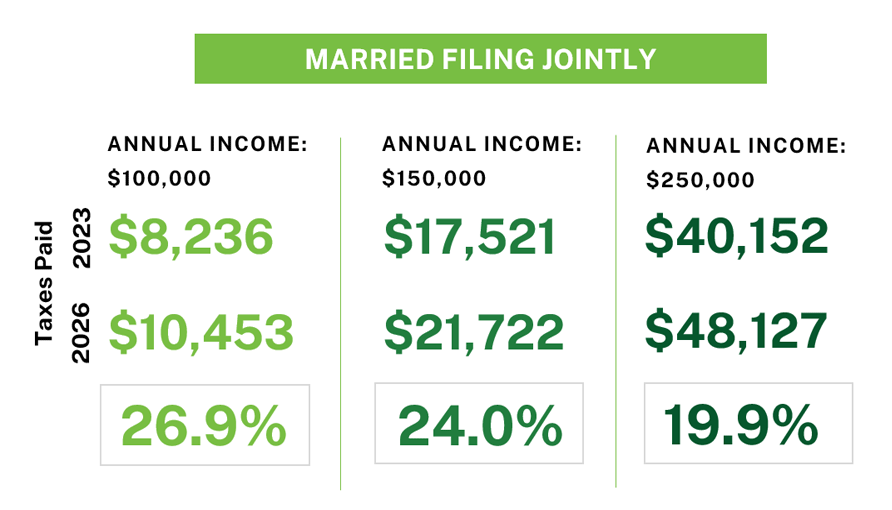

Did you know that individuals can pay about 20% more in taxes with the sunset of the Tax Cuts and Jobs Act?

On top of tax brackets changing, standard deductions and personal exemptions are set to change, too. These have the potential to have significant tax consequences.

So, tax planning is more than filing taxes and making your quarterly tax payments. There are strategies to explore and implement like Tax-Loss Selling, Withdrawal Strategies, Income Generation, Tax Bracket Management, and Asset Location – all with a balanced, holistic approach to your overall financial picture – that will allow you to keep your money growing.

Watch on-demand to learn more

Get a summary of changes for 2024, along with strategies recommended by our Tax and Financial consultants in Beyond the Numbers: Understanding 2024 Tax Changes.

Watch nowTo Do 3: Review Contribution limits

Along the lines of estate planning and tax management, review your contribution limits for 2024 to confirm you’re maximizing your contributions.

Learn more about the waterfall approach to saving – a strategy to ensure you’re maximizing your retirement savings – in 9 Steps to Building Your Retirement Savings.

With IRAs, Roth IRAs, and 401(k)s seeing increases to their contribution limits in 2024, take a moment to review how you’re saving for retirement with these accounts.

To Do 4: Stress Test Your Financial Plan

To put the figurative bow on it all, it’s always a good idea to review, update, and stress test your financial plan. This exercise helps provide peace of mind and identifies areas of improvement that align with your exact goals and lifestyle you want.

For example, with investments playing an important role in your wealth management plan, stress testing helps answer questions like, “If the markets go awry, will I be okay?” and “Can I fund all my goals without running out of money?”.

Take it a step further and find comfort in your financial plan with a comprehensive analysis that adjusts for different changes such as modifications to social security payments, premature death or unexpectedly long life, changes to healthcare costs, long-term care costs, and much more.

Are you on track? Take control today.

Transform the way you approach your finances with our free financial planning app. Filled with a variety of tools, calculators, and educational modules, MyBlocks puts you in control of your financial future. Get your free access to this powerful, interactive tool today.

During these final six months of the year, lean into planning and schedule meetings with your financial advisor, estate planning attorney, and accountant to check in and see how the sunsetting provisions and different planning strategies can be applied to your finances to keep your money growing and on track to meet your goals.

Please consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.