Passed at the end of 2019, the SECURE Act upended Required Minimum Distribution (RMD) rules for account holders and most non-spouse beneficiaries. Most notable was the increase in RMD age from 70 ½ to 72 (further increased to 73 by SECURE Act 2.0) and the elimination of the “stretch” strategy for certain non-spouse beneficiaries of retirement accounts, subjecting them to a new 10-year payout rule.

Then, in 2022, the IRS released additional proposed interpretations of the regulations put in place by the Act, asserting that if the original account holder had surpassed their Required Beginning Date (RBD) – when they must begin taking RMDs – then the beneficiary must also continue taking “stretch-style” RMDs, while also ensuring the account was empty within 10 years. In essence, inheriting an account from someone already taking RMDs requires the beneficiary to continue taking them, rooted in the IRS’s “at least as rapidly” rule.

And now, after a wait of more than two years from the proposed interpretations, they finally released the finalized regulations confirming most of the proposals, along with some additional new rules and regulations.

Let's dive in!

10-Year RMD Rule Upheld

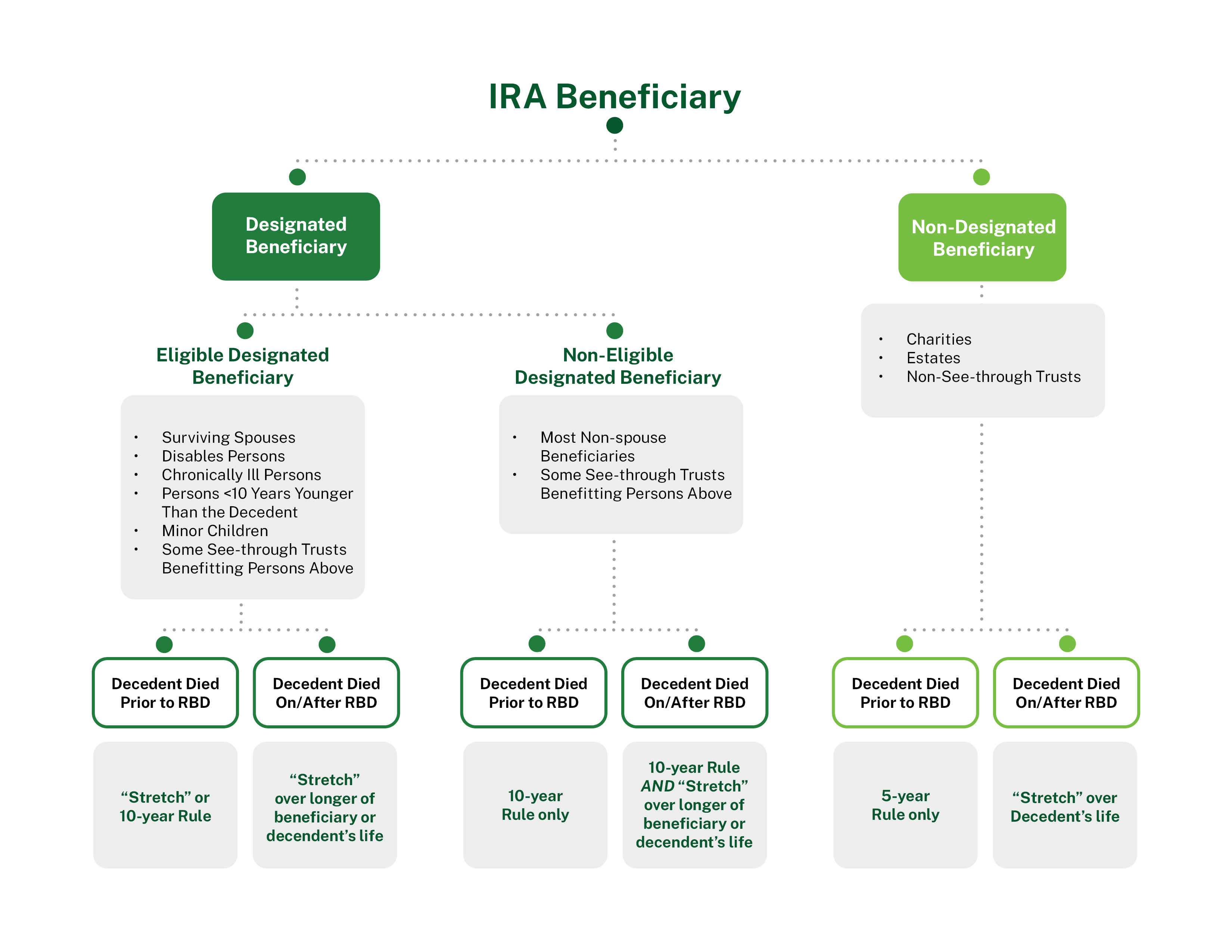

Before the SECURE Act, retirement accounts had only two types of beneficiaries: designated and non-designated.

- Designated beneficiaries were living, breathing persons who were allowed to continue “stretching” out a retirement account by continuing to take RMDs based on their life expectancy.

- Non-designated were non-living persons, like estates, trusts, and charities, and were required to empty inherited accounts within 5 years.

The passage of the original SECURE Act split the designated beneficiary group into two sub-groups: “eligible designated beneficiaries” and “non-eligible designated beneficiaries.”

- Eligible beneficiaries could continue stretching their RMDs based on their life expectancies.

- Non-eligible beneficiaries were subject to a new 10-year rule for any account inherited after 2019.

Accordingly, everyone assumed that meant the account must be empty by the end of the 10th year following the original owner's death. But like we mentioned above, the IRS finalized splitting these beneficiary sub-groups even further based on whether the original account owner died before their Required Beginning Date or on/after their Required Beginning Date (April 1st of the year after your respective RMD age), leaving us with the following beneficiary family tree:

Source: Kitces.com LLC

Going forward, inheriting an account from someone subject to RMDs will require the beneficiary to continue taking stretch-style RMDs. Then, for non-eligible designated beneficiaries only, they must ensure that the account is empty within 10 years.

Fortunately, the IRS clarified that these rules do apply starting in 2025 – and there will be no penalty, nor any need to make up “missed” RMDs, for tax years 2020-2024. However, for any accounts inherited since 2020, the 10-year clock has already started ticking, beginning the year following the year of death of the original account owner (i.e., if someone passes in 2024, then the 10-year window runs from 2025 – 2034).

Planning Tip: For those subject to the 10-year rule, spreading the distributions equally over 10 years or targeting low-income years with larger withdrawals may result in substantial tax savings compared to withdrawing the entire balance at the end of the 10th year.

Unfulfilled Year-of-Death RMDs

Even if you pass away, the IRS still wants their cut, and death doesn’t exempt individuals from having to take their RMD. As a result, if someone passes before satisfying their full RMD for the year, it must still be withdrawn, whether by the beneficiaries or the estate.

Previously, it was generally accepted that if there were multiple beneficiaries, then the RMD could be satisfied by any of them. However, now, depending on the number of accounts and number of beneficiaries, it can get a little complicated (and lead to potential privacy concerns):

One account with multiple beneficiaries: The RMD can be satisfied by one beneficiary or taken collectively and divided however they wish.

Multiple accounts with multiple beneficiaries: The total combined RMD, less total RMDs taken before death, will have to be taken proportionately from each account based on prior year-end values by the respective beneficiaries of each account. Should there be multiple beneficiaries receiving different amounts from different IRAs, it could potentially lead to awkward situations of beneficiaries realizing they were “shortchanged.”

Planning Tip: For those with multiple, unequal sized IRAs, with different beneficiaries, satisfying RMDs earlier in the year may help to avoid uncomfortable circumstances should you pass during the year.

Other Notable Changes

Designated Roth Assets

The IRS also clarified that all Roth account owners are deemed to have passed before their Required Beginning Date, regardless of their age when they passed. As a result, anyone subject to the new 10-year payout rules will not be subject to the stretch-style RMD requirements. The same rule applies to Roth assets within a designated employer-sponsored plan account. However, even if $1 of pre-tax money is mixed in with the Roth assets (incredibly likely in an employer plan like a 401(k)), then it disqualifies the Roth designation with respect to these updated RMD rules.

Planning Tip: If you have substantial Roth assets commingled with pre-tax or after-tax assets in your employer plan, exploring regular in-service distributions of the Roth assets to a Roth IRA could provide substantial future tax savings for beneficiaries subject to the 10-year rule.

Roth Conversions

Because the stock market tends to rise over time, it was shrewd for an individual to split their IRA into multiple IRAs and execute Roth conversions from one account early in the year and then satisfy RMDs from another account later in the year, thus enhancing long-term tax savings. This is no longer the case. For those considering Roth IRA conversions, RMDs for the current year from all IRAs must now be satisfied before any conversions can take place.

The final regulations generally mirror the proposals from two years ago and will likely impact anyone with a retirement account. For those impacted, the shortened timeframe for withdrawals will create opportunities to balance taxes, financial goals, and investment strategies. Whether you are the owner, or a potential beneficiary, it will be important to work with an advisor to understand your options.

We can help

Start the conversation today by scheduling a call with a Financial Consultant who will provide a complimentary, custom-tailored financial plan to help you reach your goals.

Start todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.