Key takeaways

- A well-structured financial plan provides a roadmap to navigate the complexities of personal finance

- Elements of a financial plan include financial goals, current and ongoing financial assessments, day-to-day budget, debt management, risk management, investment plan, retirement planning, strategic tax planning, and estate planning

- Long-term financial success requires regular monitoring and stress testing

Who doesn’t want a roadmap guiding them towards achieving their financial goals and securing their future? That’s where a comprehensive financial plan comes in. It encompasses various aspects of your financial life, providing a clear picture of your current situation and outlining strategies to reach desired milestones. By addressing income, expenses, savings, investments, insurance, and taxes – a financial plan sets the foundation for informed decision making to help with long-term financial success.

And that’s the key focus when it comes to wealth management and financial planning – long term. It’s a commitment today, tomorrow, ten years from now, and so on. Sure, things will change, and your plan will evolve, but no matter what, you’ll be working towards a financial picture and lifestyle that’s appropriate for your situation.

With that said, no two plans will look exactly the same. However, every plan should account for the following.

Your Financial Goals

An obvious first one, yet it can’t go unsaid, at the core of any financial plan are clearly defined financial goals. These goals are centered around retiring comfortably, saving for a down payment on a house or vacation home, funding a child's education, or starting a business. By articulating these objectives on paper, you can align your mindset and financial efforts towards achieving them.

The Ultimate Financial Planning Checklist

Whether you’re creating a plan for the first time, or reviewing your existing one, ensure you’re not missing key details with the help of this free download, covering the components and factors needed in a financial plan that account for today and tomorrow.

Get your copyCurrent and Ongoing Financial Assessments

After outlining your goals, you need to step back and assess your current financial situation to identify any hurdles in the way of a successful plan. This involves analyzing income, expenses, assets, liabilities, and net worth. Your assessment provides a baseline understanding of where you stand financially and identifies areas that require attention or improvement.

What if you already have a financial plan? Well, a plan is never “set it and forget it” so it’s always a good idea to review it regularly and, if possible, stress test your plan. Stress testing involves running your plan through “Bad Timing” and “Monte Carlo” simulations which can help visualize how your plan would withstand market ups and downs.

Your Day-to-Day Budget

As we mentioned, financial plans are viewed with a long-term lens, but that doesn’t mean short-term or day-to-day habits don’t matter. That’s why a key element of a financial plan is creating and adhering to a budget. By tracking income sources and monitoring expenses, a budget helps individuals gain control over their finances. It ensures that spending aligns with financial goals and helps identify areas where adjustments can be made to save more effectively.

Track Debt Management

Managing debt is crucial for long-term financial stability. A financial plan includes strategies to tackle and pay off debt effectively. This may involve prioritizing high-interest debt, exploring debt consolidation options, and creating a repayment plan that aligns with financial capabilities.

Risk Management

Mitigating potential risks is a vital aspect of a financial plan because without this layer any hiccup can throw your plan awry. Adequate insurance coverage, including health insurance, life insurance, disability insurance, or property insurance, can help protect you and your families from unforeseen events that could lead to financial hardship.

Investment Plan

Developing an investment strategy is quintessential to growing wealth and achieving financial goals. Based on risk tolerance, time horizon, and objectives, a financial plan outlines the appropriate asset allocation and diversification strategy. It will guide you in selecting suitable investment vehicles such as stocks, bonds, or mutual funds.

Retirement Planning

A robust financial plan includes retirement planning to ensure a comfortable post-work life. By estimating retirement needs, considering factors like Social Security benefits and retirement age, and maximizing contributions to retirement accounts like 401(k)s or IRAs, you can build a nest egg to support their desired lifestyle during retirement.

Strategic Tax Planning

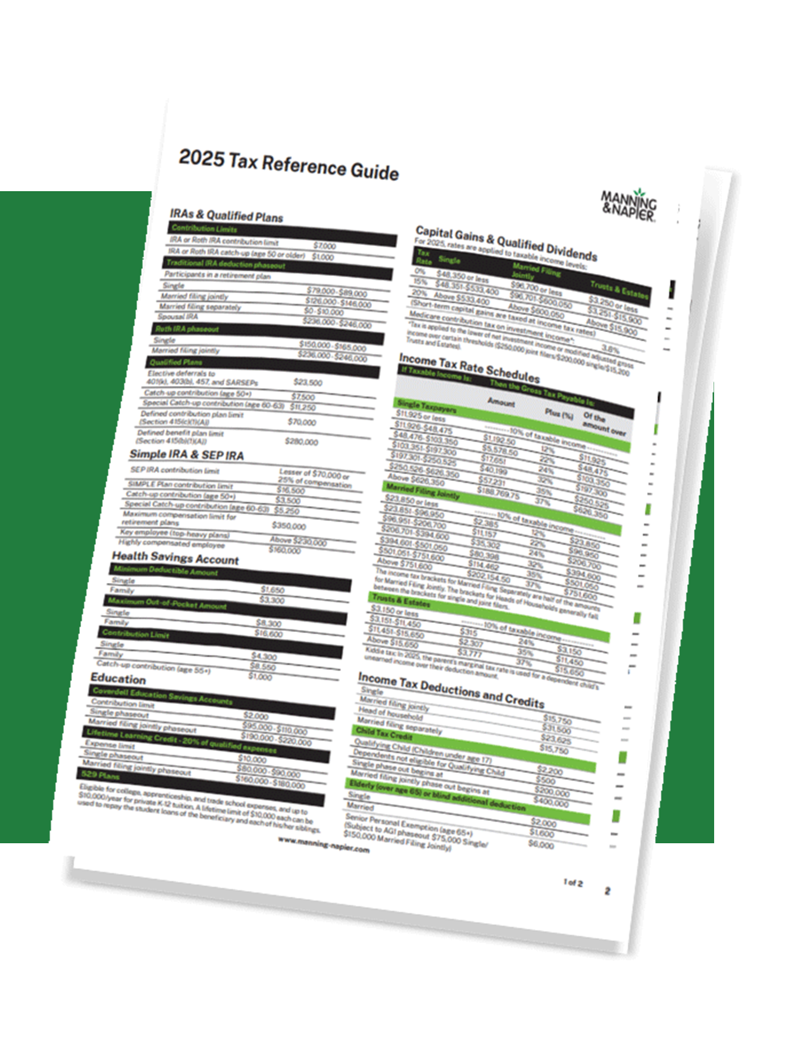

Optimizing tax efficiency is an integral part of a financial plan. By understanding tax laws, utilizing tax-efficient investment strategies, maximizing available deductions and credits, and making informed decisions about retirement accounts, you can minimize your tax burden and maximize your savings.

2025 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2025 tax year in just one place.

Download your free copiesEstate Planning

Estate planning is often overlooked but crucial for wealth transfer and legacy preservation. A financial plan addresses considerations like beneficiary designations, wills and trusts, powers of attorney, healthcare directives, and other aspects of estate planning to ensure that assets are distributed according to your wishes.

A comprehensive financial plan is an invaluable tool when seeking financial security to achieve your goals. By addressing income, expenses, savings, investments, insurance, taxes, and more, a well-structured financial plan provides a roadmap to navigate the complexities of personal finance. With careful planning, regular monitoring, and a commitment to sticking to the plan, you can move closer to your financial aspirations and build a brighter future.

We can help

Start the conversation today by scheduling a call with a Financial Consultant who will provide a complimentary, custom-tailored financial plan to help you reach your goals.

Start todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.