We all love to see our investment portfolios grow. What we’re less excited about is the taxes on our profits, also known as capital gains. Similar to investments, when it comes to your financial plan, there are a handful of variables that can impact your tax bill.

Tax planning and management focuses on smoothing your taxes over the long-term to help mitigate your tax liability. With different strategies and tactics available, there are ways to manage your capital gains tax. However, it’s important to mention that you can't avoid these taxes, aside from two instances – upon death (with a step-up in basis) or a market downturn (eliminating your gain), neither of which are ideal for obvious reasons.

Watch Mastering 2025 Tax Strategies on-demand to learn more about taxes

Learn last-minute planning opportunities for the 2024 tax season, the changes that will impact your 2025 taxes, and leading strategies to proactively optimize your tax plan.

Watch nowUnderstanding Capital Gains Tax

To begin, capital gains are the profits from the sale of an asset (e.g., shares of stock, bonds, property, business interest, etc.) and are generally considered taxable income.

The first categorization of capital gains is ‘unrealized’ or ‘realized.’ Unrealized gains are when you have a profit only on paper. You don’t have to pay any taxes until you sell the asset, which becomes a realized gain.

Realized gains are the trigger for capital gains tax, and the rate at which capital gains are taxed depends on how long you held the asset before selling. To be considered ‘long-term’ and benefit from a lower tax rate, an asset must be owned for more than a year. If your capital gain qualifies, then it’s taxed at a favorable set of rates.

Assets held for less than a year are considered ‘short-term’. These short-term capital gains are taxed according to less favorable income tax rates.

Netting Capital Gains

During the course of a year, securities may be sold at a gain or a loss (selling for less than it was originally purchased). When calculating capital gains, any gains and losses are added together to reach a net gain or loss figure.

For instance, if you have $10,000 of realized capital gains during a year and $8,000 of realized capital losses, you will have a net capital gain of $2,000. To take advantage of this netting effect, there is a tax planning strategy called ‘tax-loss selling’ that aims to tactically and temporarily sell select securities at a loss to reduce taxable gains.

Calculating Tax Capital Gains

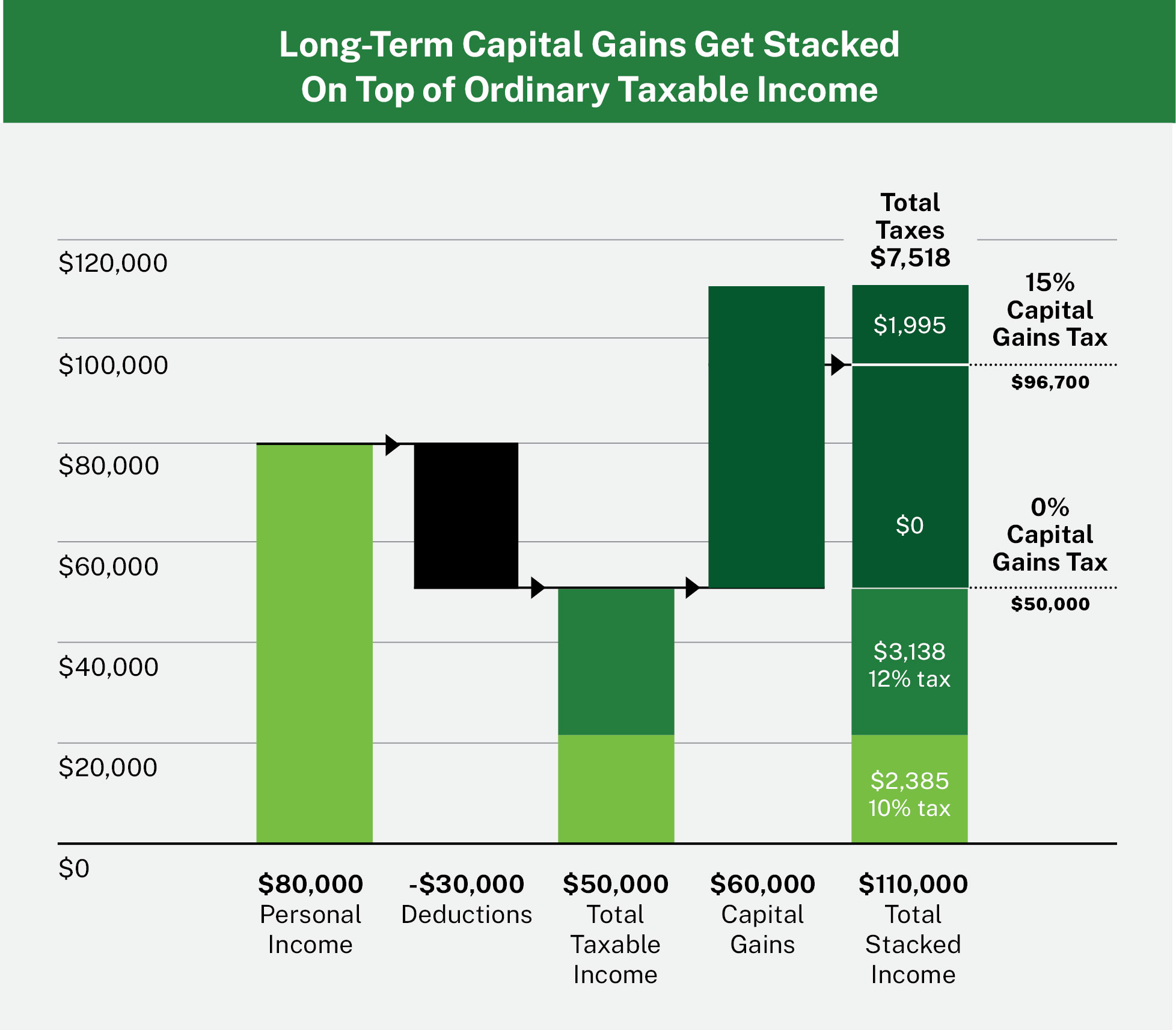

The calculation of capital gains taxes is often an area of confusion, even for sophisticated investors. Income from all sources including wages, interest, retirement plan distributions, dividends, and capital gains, are all added together to reach gross income, and then are taxed at different rates. Investors often wonder whether selling an asset at a large gain will push them into a higher income tax bracket.

Understanding how these taxes work together, or ‘stack’, can best be explained with the below illustration.

Source: Kitces.com. For illustrative purposes only.

How to Manage Capital Gains in 2025

There are different strategic approaches to managing capital gains, as careful planning around them is essential to help mitigate your tax liability – however, use caution on how your tax bill is influencing your decisions. Managing capital gain can be helpful, but you don't want the tax tail to always wag the investment dog.

A key consideration in managing capital gains is knowing the risk associated with having a concentrated position in a single asset. While a large investment that has appreciated in value can lead to significant capital gains, it also can carry substantial risks if the asset performs poorly. Diversification is a powerful strategy to not only reduce concentration risk but also manage the tax impact of future capital gains by spreading out taxable events over multiple investments. In 2025, reviewing your portfolio for concentration risks and taking steps to diversify could help protect both your investment returns and your long-term tax liability.

One of the most effective ways to manage capital gains taxes in 2025 is through proactive tax-loss selling. This involves selling investments at a loss to offset gains from other investments. By realizing a loss, you can offset taxable capital gains, potentially lowering your overall tax liability.

Emotional attachment to investments can also play a role in capital gains management. It’s important to separate emotions from financial strategy – being able to objectively assess whether selling or holding an asset is appropriate for your broad financial plan and tax strategy. Having a financial advisor you trust can help make objective decisions to remove the emotion from making changes. The basis step-up is another tax strategy that can help mitigate capital gains, which occurs when an asset is inherited. The stepped-up basis allows heirs to avoid paying capital gains taxes on the appreciation that occurred while the original owner held the asset. This can be a significant advantage in managing gains. Understanding how this works is crucial for estate planning and for managing capital gains tax obligations during an inheritance.

As we said at the beginning, capital gains can only be avoided at death or taken away during a market downturn, therefore, managing capital gains in 2025 involves a combination of long-term strategic planning and tax strategies. By keeping the above factors in balance with your advisor, you can have a conscientious plan to minimize your tax liability while staying aligned with your broader financial goals.

We can help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. Start the conversation today by scheduling a call with a member of our team. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

Schedule a free consultation todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.