Retirement Security Rule: Definition of an Investment Fiduciary (Fiduciary Rule) and amendments to Prohibited Transaction Exemptions (PTE)

In April 2024, the DOL issued the final version of its Retirement Security Rule which imposes an ERISA fiduciary standard. Staying informed about and compliant with the new Rule is crucial for financial professionals to uphold ethical standards, maintain client trust, and operate successfully within the industry. Below are some questions and answers to help break down some of the key changes as well as a checklist to aid in complying with the new rule.

What is the Fiduciary Rule and what are the PTE amendments?

On April 25, 2024, the Department of Labor (DOL) released the Fiduciary Rule, which expands the definition of an investment fiduciary under the Employee Retirement Income Security Act of 1974 (ERISA). Simultaneously, the DOL released a number of amendments to existing PTEs that alter the conditions under which a person deemed to be an investment fiduciary can receive direct or indirect compensation without violating ERISA. Going forward, all fiduciary investment advice transactions must comply with PTE 2020-02, the exemption most broadly applicable to you, or PTE 84-24, which is tailored to investment recommendations by independent insurance agents who offer insurance solutions of more than one insurance company. With this rulemaking package, the DOL intends to evolve the regulatory mandates to address changes in the retirement landscape (e.g., more defined contribution plans and IRAs and fewer defined benefit pension plans) and afford additional protections around retirement assets.

In departing from the long-standing five-part test, the DOL adopted a new definition of investment advice fiduciary that focuses on whether the person making a recommendation is in the business of providing advice. Therefore, as an advisor, you should be mindful of the fact that you could be deemed to be an investment advice fiduciary even if you make a one-time recommendation to a retirement investor. Importantly, if you are in the business of providing advice, whether as an investment advisor, broker-dealer, insurance agent, bank, or otherwise, and you desire to receive compensation for your services, you will need to rely on exemptive relief.

Old Definition of Investment Advice Fiduciary

For a fee or other compensation:

- Render advice as to the value of securities or other property, or make recommendations as to the advisability of investing in, purchasing, or selling securities or other property

- on a regular basis

- pursuant to a mutual agreement, arrangement, or understanding with the plan or a plan fiduciary that

- the advice will serve as a primary basis forinvestment decisions with respect to plan assets, and that

- the advice will be individualized based on the particular needs of the plan

New Definition of Investment Advice Fiduciary

For a fee or other compensation, provide a recommendation in one of the following contexts:

- The person either directly or indirectly makes professional investment recommendations to investors on a regular basis as part of their business and the recommendation is made under circumstances that would indicate to a reasonable investor in like circumstances that the recommendation:

- Is based on a review of the retirement investor’s particular needs or individual circumstances,

- Reflects the application of the professional or expert judgement to the retirement investor’s particular needs or individual circumstances, and

- May be relied upon by the retirement investor as intended to advance the retirement investor’s best interest; or

- The Person represents or acknowledges that they are acting as a fiduciary under Title I of ERISA, Title II of ERISA, or both with respect to the recommendation

What is going to change?

Many advisors already treat all advice to retirement investors as fiduciary advice under ERISA and comply with PTE 2020-02 in order to receive compensation. If this describes you then the practical implications of the rulemaking will be less burdensome. Your compliance effort will necessitate changes to disclosures, documentation, and communications, but rollover recommendations will actually require less work. The DOL modified the pre-existing fiduciary acknowledgment requirement under PTE 2020-02 to specifically require you to provide a written statement of your care and loyalty obligations under ERISA. Fortunately, the DOL provides model language that you are permitted and encouraged to use for this purpose. Similarly, you will now have to provide a more in-depth written disclosure pre-transaction that describes all material facts relating to the scope and terms of your relationship with the retirement investor, including fees and costs, type and scope of services and material limitations thereto, and all material facts relating to conflicts of interest. In a change from more rigid requirements of the prior version of PTE 2020- 02, the DOL now requires a specific rollover disclosure only when you recommend that a retirement investor roll assets out of an ERISA plan. You no longer have to provide this rollover disclosure for IRA to IRA rollovers.

What types of recommendations and transactions are in scope?

In addition to recommendations of account type, investment vehicle and specific securities (stocks, bonds, mutual funds, and similar instruments), PTE 2020-02 will now provide exemptive relief for principal transactions, robo-advice arrangements, and other types of transactions that were not previously covered under PTE 2020-02.

When does it go into effect?

Both the Fiduciary Rule and amendments to PTE 2020-02 take effect on September 23, 2024 (“Applicability Date”). You can rely on the prior version of PTE 2020-02 for transactions that occur prior to the Applicability Date. The DOL has provided a one-year transition period following the Applicability Date to come into compliance with all conditions of the amended PTE 2020-02 but you must adhere to the Impartial Conduct Standards and Fiduciary Acknowledgement requirements of during this phase in period. Compliance with the Impartial Conduct Standards requires you to provide advice that is the retirement investor’s best interest, eliminate and minimize conflicts of interest, avoid misleading statements or omissions that would be misleading, and charge only reasonable compensation. You must also provide retirement investors with an acknowledgement of your status as a fiduciary, preferably using the DOL’s model language. After the one-year phase-in, you will need to comply with the remaining requirements: conflicts disclosure, modified rollover disclosure, policies and procedures and an annual review and remediation process. While the Fiduciary Rule is already subject to legal challenges and ample speculation around its survival, we strongly recommend that you take the necessary steps to comply with the updated regulations and not wait to see what plays out in the courts.

Who is a retirement investor?

The Rule and PTE 2020-02 defines a retirement investor as a participant/owner or beneficiary of defined contribution plans, IRAs, HSAs, 403(b) plans, Keogh plans, SIMPLEs, SEPs, Archer MSAs, & Coverdell ESAs.

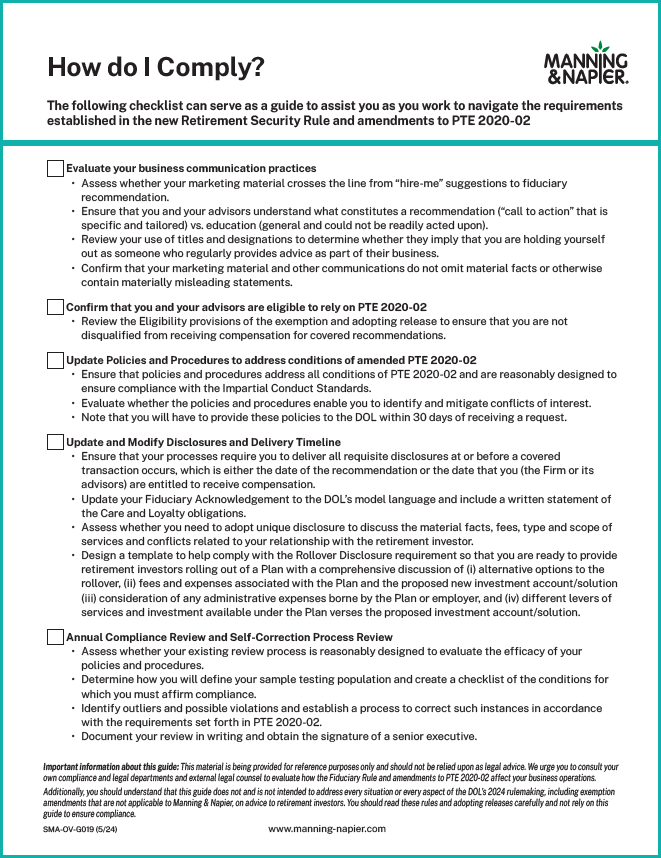

How do I comply?

There are a number of things you can do to prepare for and navigate the requirements established in the new Retirement Security Rule and amendments to PTE 2020-02. Download our new checklist to get a simple breakdown of what you need to do next to be prepared.

Download your copy

This material is being provided for reference purposes only and should not be relied upon as legal advice. We urge you to consult your own compliance and legal departments and external legal counsel to evaluate how the Fiduciary Rule and amendments to PTE 2020-02 affect your business operations.

Additionally, you should understand that this guide does not and is not intended to address every situation or every aspect of the DOL’s 2024 rulemaking, including exemption amendments that are not applicable to Manning & Napier, on advice to retirement investors. You should read these rules and adopting releases carefully and not rely on this guide to ensure compliance.