Typical life events can have a larger-than-expected impact on your tax bill. These events can range from inheritance of estate and retirement assets or selling real estate, to Medicare and Social Security. The point is that taxes are inevitable. Luckily, there are strategies and planning that can proactively help smooth your tax bill.

We’re all familiar with the IRS and different legislation (Tax Cut and Jobs Act) which provide rates, rules, and regulations that set parameters and provide opportunities – if you know how and when to implement them.

So, are you making the most out of current tax law opportunities to minimize future tax events? As these parameters change from year to year, applying a proactive tax plan as part of your overall financial plan is a critical factor in managing your tax bill, now and in the long-term.

If you don’t have a current, proactive tax management strategy, here are four reasons you should schedule a consultation, today.

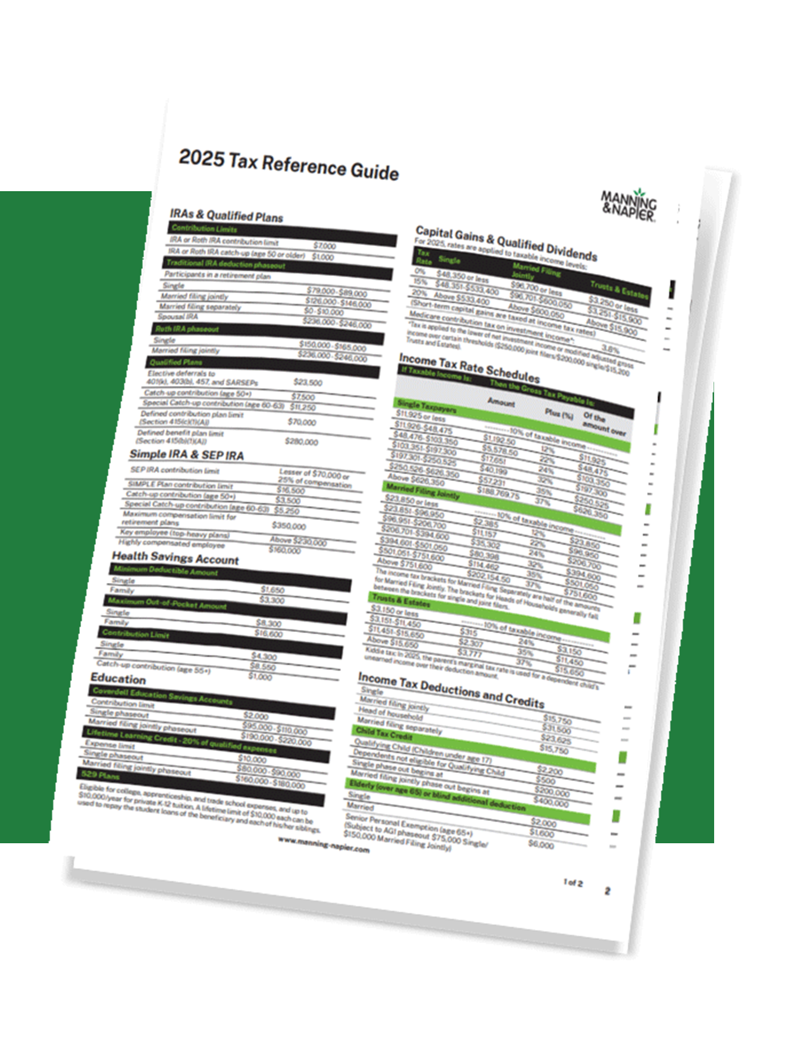

2025 Tax & Planning Guides

Download these quick reference guides for all you need to know about taxes, Social Security, and Medicare for the 2025 tax year in just one place.

Download your free copies4 Benefits of a Tax & Wealth Consultation

- Pay less taxes than you have to – either now or over the long-term.

As mentioned, changing rules and regulations put pressure on individuals to take advantage of historically low rates by implementing a tax strategy today to help smooth taxes over time. This opportunistic environment is set to change as the Tax Cut and Jobs Act expires at the end of 2025 (without action from lawmakers). - Gain a 360° view of your financial health.

Taxes, like investments, are only one component of your holistic financial picture. It takes an integrated approach to ensure that all of your strategies are working in harmony to achieve your goals. And while you need an integrated approach, tax planning is not a one-size-fits-all solution. Your financial picture is unique to you and deserves a thorough assessment to identify areas of improvement and strategies to consider as you work your way toward your goals. - Understand how different elements impact your tax bill.

Did you know that Medicare Part B and D premiums are impacted by modified adjusted gross income? Or that Income-Related Monthly Adjustment Amount (IRMAA) has a hidden tax? What about that Social Security tax is based on income? Taxes are nuanced – and understanding how your situation is impacted by changing rules and regulations is, truthfully, confusing. From Medicare and Social Security to Roth conversions and estate planning – taxes are part of it all, making it important to know exactly what impacts your tax bill. - Learn expert insight and actionable ways to incorporate leading strategies.

There are other planning techniques to be aware of. Tax-loss selling strategically reduces realized gains, withdrawal strategies assess the source and how it can impact taxes, income generation plans how accounts generate taxable income, and tax management and asset allocation to help with income smoothing. This list goes on. Leverage the expertise of professionals who live and breathe tax rules and laws to create the best plan for you.

At the end of the day, taxes are more than tax returns and checks to the IRS, and certainly should be considered outside the April 15th timeframe. We’re here to help quarterback your success by analyzing your whole financial picture, understanding your goals, and coordinating with your team of professionals – CPA, Financial Advisor, and even your Estate Attorney – to have the best outcome possible.

We can help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. Start the conversation today by scheduling a call with a member of our team. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

Schedule a free consultation todayPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.