This annual outlook reflects our current views of the economy, markets, and holistic wealth management from Manning & Napier’s Investment Policy Group. This group discusses, analyzes, and dissects major macroeconomic variables including the economy, global financial markets, and asset allocation to ultimately determine the firm’s views.

Letter from our Investment Policy Group

The Great 8 (Magnificent 7 + The Fed)

―

The path from January through the end of the year was anything but a straight line. Investors walked a winding path through 2024 from concerns about the persistence of inflation, to mid-summer worries about labor markets, to a presidential election that will bring with it a significant change in government. Treasury yields have broken out of a multi-decade downward trend and may be reflective of a more inflationary future. Yet, commodity prices remain depressed. While the range of economic outcomes remains wide and potentially binary, credit spreads are sending a message of calm.

However, when financial market historians look back on 2024 it will likely be remembered for the Magnificent 7 (Mag 7) group of US mega cap stocks and the Federal Reserve (the Fed). The Mag 7 dominated the global equity market landscape and helped further the decade-long dominance of US large company growth stocks over virtually every other equity investment type. Meanwhile, the Fed finally began its long-anticipated easing cycle and reduced the federal-funds rate by a full percent between September and the end of 2024.

These factors are likely to play a key role in 2025 as well. The investment implications, however, may be materially different. Popular US stock market indexes, such as the S&P 500, begin the year at historically high levels of both valuation and concentration. History says that eventually these factors will function as gravity and bring down future returns. While some may see this as bad news, we are excited about the many investment opportunities that have been neglected by the market in recent years. We believe there are compelling investments out there for those willing to do the work and look for opportunities a little off the beaten path. This theme of selective opportunities is true both in equities as well as in fixed income.

What’s needed in such an environment is a measured, active approach to managing risk and maximizing opportunities in financial markets. Though major domestic equity indexes look priced to perfection, we continue to find attractive opportunities. Volatility in yields has afforded us ample opportunity to adjust duration in the Treasury market while also uncovering opportunities in markets ranging from municipal bonds to asset-backed securities to investment and non-investment grade corporate bonds. Our partnership with the Callodine Group and its deep experience in private credit has enabled us to collaborate and uncover attractive opportunities backed by strong asset bases.

The past two years of US equity market returns have been exceptional and have undoubtedly brought many individuals and institutions closer to meeting their investment objectives. We believe that successfully building on these results going forward will require a diversified portfolio backed by thorough research and time-tested investment strategies.

Learn more about our Outlook

Watch our Annual Outlook Webinar on-demand to hear directly from our team on how key economic trends and market dynamics are influencing your financial plan with actionable strategies to help you stay confident and in control, no matter what the year brings.

Watch nowWealth Planning

Keys to Wealth Management

―

Markets and the economy are merely two elements impacting your financial plan. Key life moments – like marriage or retirement – changing legislation and regulations, and the status of your goals, all carry weight in the ability to build, grow, and share your wealth.

While we always recommend annual reviews of your plan and portfolio, the recent market performance sparks an opportunity to review your investments and risk tolerance against your objectives and financial plans. Beyond markets, the economic landscape will continue to evolve as the Fed’s rate campaign carries over to 2025 and the election results are felt as the new administration begins to execute its agenda. With that said, we caution against focusing solely on the near-term and encourage a holistic, long-term view to identify strategies for tax management, charitable planning, estate planning to complement market performance, and to keep you on track to grow and share your wealth.

As we’re managing your investments, here are reminders of actions you can take to stay in control and confident of your finances.

Dates to Add to Your Calendar

January 1st

- New retirement plan, IRA, and HSA contribution and income limits go into effect

January 15th

- Fourth quarter 2024 estimated tax payment due

April 15th (Tax Day)

- Individual tax returns due

- First quarter 2024 estimated tax payment due

- Last day to make a 2024 IRA or HSA contribution

June 16th

- Second quarter 2025 estimated tax payment due

September 15th

- Third quarter 2025 estimated tax payment due

October 15th

- Individual tax returns due for those who received a six-month extension on 2024 returns

December 7th

- Medicare Open Enrollment due date ends

December 31st

- Last day for 401(k) contributions

- Deadline to take RMDs from traditional IRA and 401(k)s (except for those taking their first RMD)

Financial Wellness Checklist

Your day-to-day: Finances are never static. Review how your wealth is being allocated each and every day.

- Make a budget and review your spending.

- Review savings progress and set goals for the next year.

- Review FSA or HSA contributions. If possible, maximize contributions for tax savings and employer matches.

- Review all insurance policies - home, auto, and life - to determine if you have enough coverage, or if deductibles need to be adjusted.

- Evaluate credit cards and auto and home loans and consider possible refinancing options.

- Request and check a free copy of your credit report.

- Ensure your emergency account is fully funded for 3 to 6 months’ worth of expenses.

Your future: There is no time like the present to start preparing your future for financial stability, right?

- Review and update the beneficiaries on retirement accounts and life insurance policies.

- Review your estate plan and trust documents. Ensure your overall estate plan, including your will, trust, and durable power of attorney and health care proxy are current.

- Assess 401(k) and IRA contributions. If possible, maximize the amount you can contribute, taking advantage of available tax savings and employer matching.

- Consider a charitable gift for the year to take advantage of the tax savings.

- Stress test your financial plan to see how it can withstand different market scenarios and conditions.

Your next meeting agenda: During your next meeting with your advisor, consider these topics for discussion.

- Share any personal or financial changes that have occurred that may impact your financial plan.

- Express any changes or preferences in your goals or risk tolerance.

- Discuss ways you can better manage your taxes.

The Economy

The Resilient US Economy

―

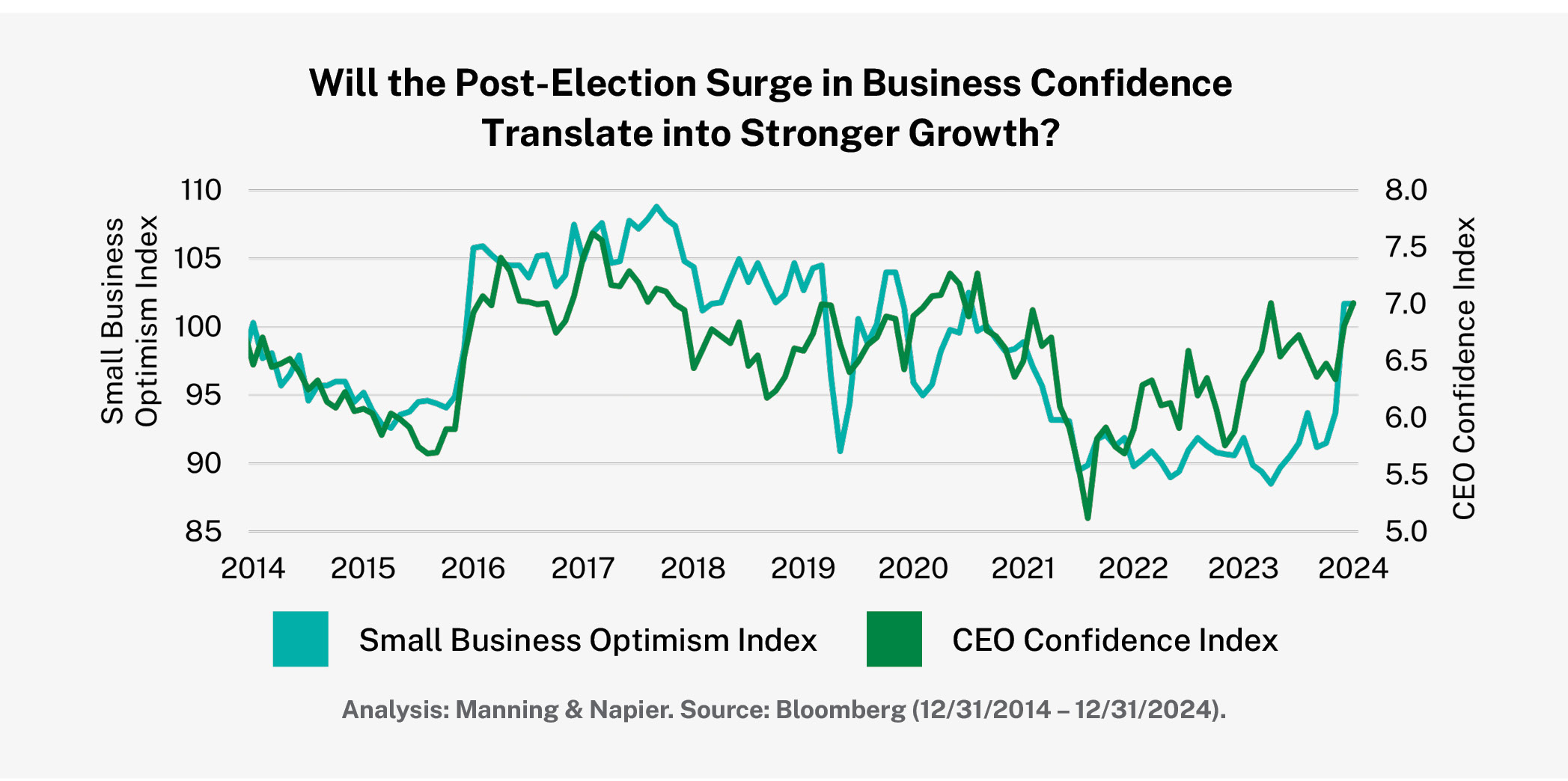

Resiliency is perhaps the best description of the US economy in 2024. Economic growth continued at a respectable pace despite notable weakness in manufacturing, some signs of consumer stress, and a fast-changing interest rate environment. As we move into 2025, the key question is if the economy can shift into a higher gear to drive consumption and earnings growth in the quarters ahead.

Key takeaways:

- The US economy enters 2025 in far better shape than the financial markets expected at the outset of 2024. This has important implications for the path of monetary policy and the trajectory of corporate earnings and consumption.

- Uncertainty around the incoming Trump Administration (tariffs, immigration, taxes, etc.) combined with inflation that remains above policymakers’ targets, increases the risk of interest rate volatility.

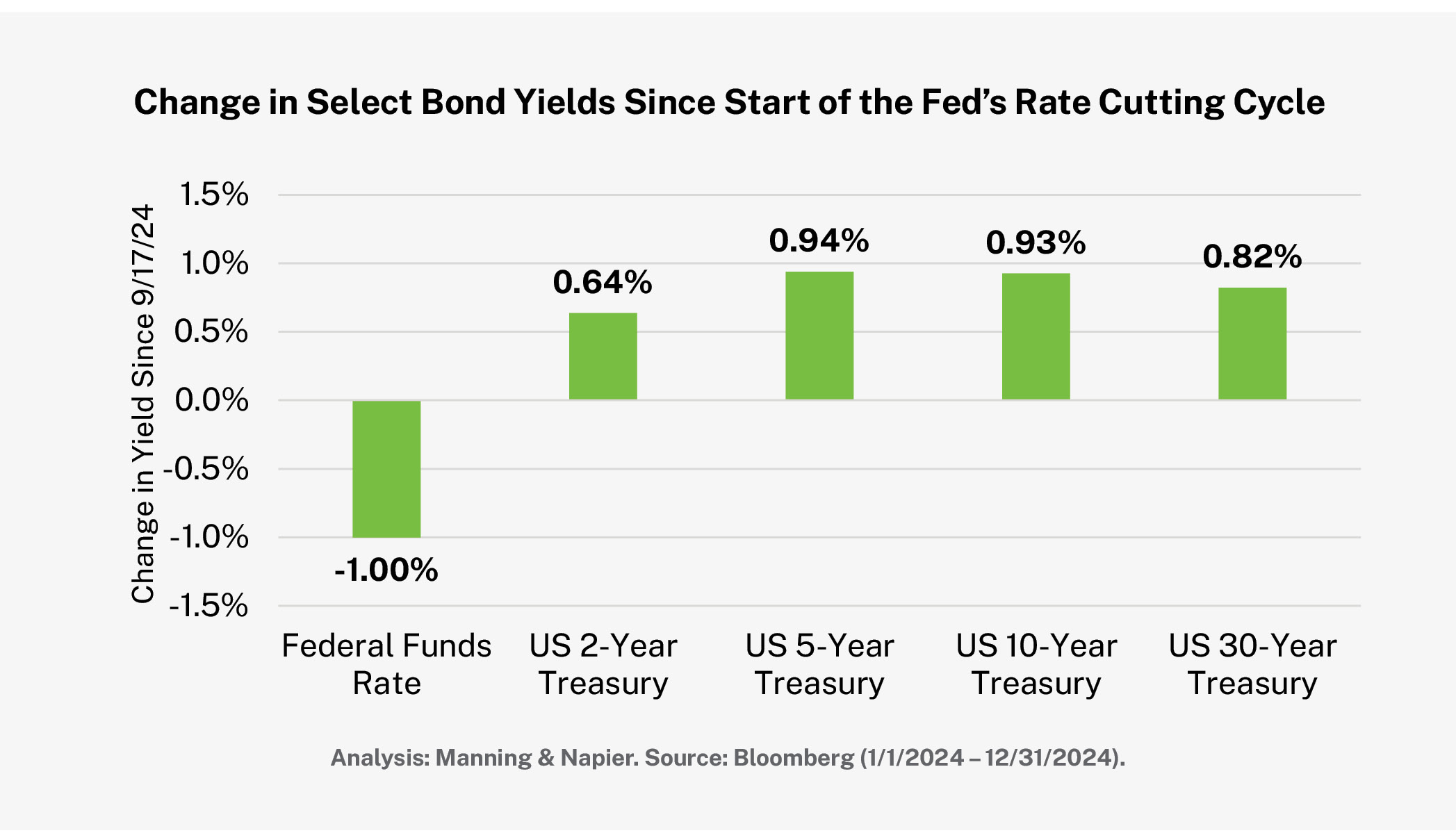

2024 began with expectations for a weaker US economy and an aggressive pace of rate cuts by the Fed. However, sticky inflation and solid, if not spectacular, economic growth kept policymakers on the sideline for most of the year. The Fed finally commenced the long-awaited easing cycle in September with a 50-basis point (0.5%) cut.

The Fed would cut rates twice more in 2024 (25-basis points each), bringing the Fed Funds rate down a full percentage point from its recent peak. These cuts occurred despite inflation running well above the central bank’s 2% target, and the economy staring down additional policy uncertainty following the 2024 election.

What comes next?

The economic data at the start of 2025 offers talking points for bulls and bears alike. Housing has been, and remains, a significant drag on economic activity. Non-residential investment has been strong for several years, and is clearly in a decelerating trend.

Meanwhile, labor markets remain solid—despite some warning signs—and household net worth continues to make all-time highs. This backdrop remains supportive of consumption though lower-income consumers continue to struggle. With the Fed cutting, there is hope for relief in rates, and pent-up demand could spur activity in the housing market. Deregulation and a revival in animal spirits could combine to improve the lending environment, with banks easing lending conditions and credit growth potentially putting in a bottom.

Policy will likely have a role to play too. The incoming administration ran on a campaign centered around tariffs, lower taxes, and securing the border. Tariffs may incentivize domestic investment and consumption, while an extension of the 2017 Tax Cuts and Jobs Act would remove the risk of a reset to higher tax rates. These policies at face value are likely to be growth positive. Yet, there are also reasons for caution. Tariffs and a reduction in immigration, when inflation is already running above target, could add upward pressure on prices.

The Fed may control the cost of overnight borrowing, but the price of longer-term funding is determined by the bond market. The economic crosscurrents present today are likely a perfect recipe for interest rate volatility in the new year. Swings in rates may provide attractive entry points both in fixed income and in equities as the moves reverberate through the financial system.

The Market: Equities

It’s Lonely (and Risky) at the Top

―

Investors in 2024 were rewarded for simply being in the market. Of course, by market, we are referring specifically to the S&P 500 and its high-octane cousin, the NASDAQ 100. Technology-related companies, particularly those associated with the booming business of artificial intelligence (AI) have seen stock prices soar, driven by explosive growth and expectations of even more to come.

The new year begins with these market indexes seemingly priced for perfection and incredibly beholden to the fortunes of just a few companies. This level of concentration is clearly a risk for investors who solely own the market. However, for those with the ability to invest beyond market cap-weighted indexes we believe there are meaningful opportunities ahead.

Key takeaways:

- The dominance of domestic equities, particularly very large growth-oriented companies, has reached levels not seen in decades. As a result, a massive valuation gap has opened between US large cap growth companies and most other types of equity investments (e.g., small caps, international and value).

- Such an environment should favor an active approach to investment management. This is true for both managing the risks of index concentration and high expectations, as well as finding opportunities in seemingly forgotten areas of the market.

The S&P 500 delivered its second straight year of returns in excess of 20%. Earnings growth accounted for a strong share of these gains, but multiple expansion was similarly important in driving markets higher.

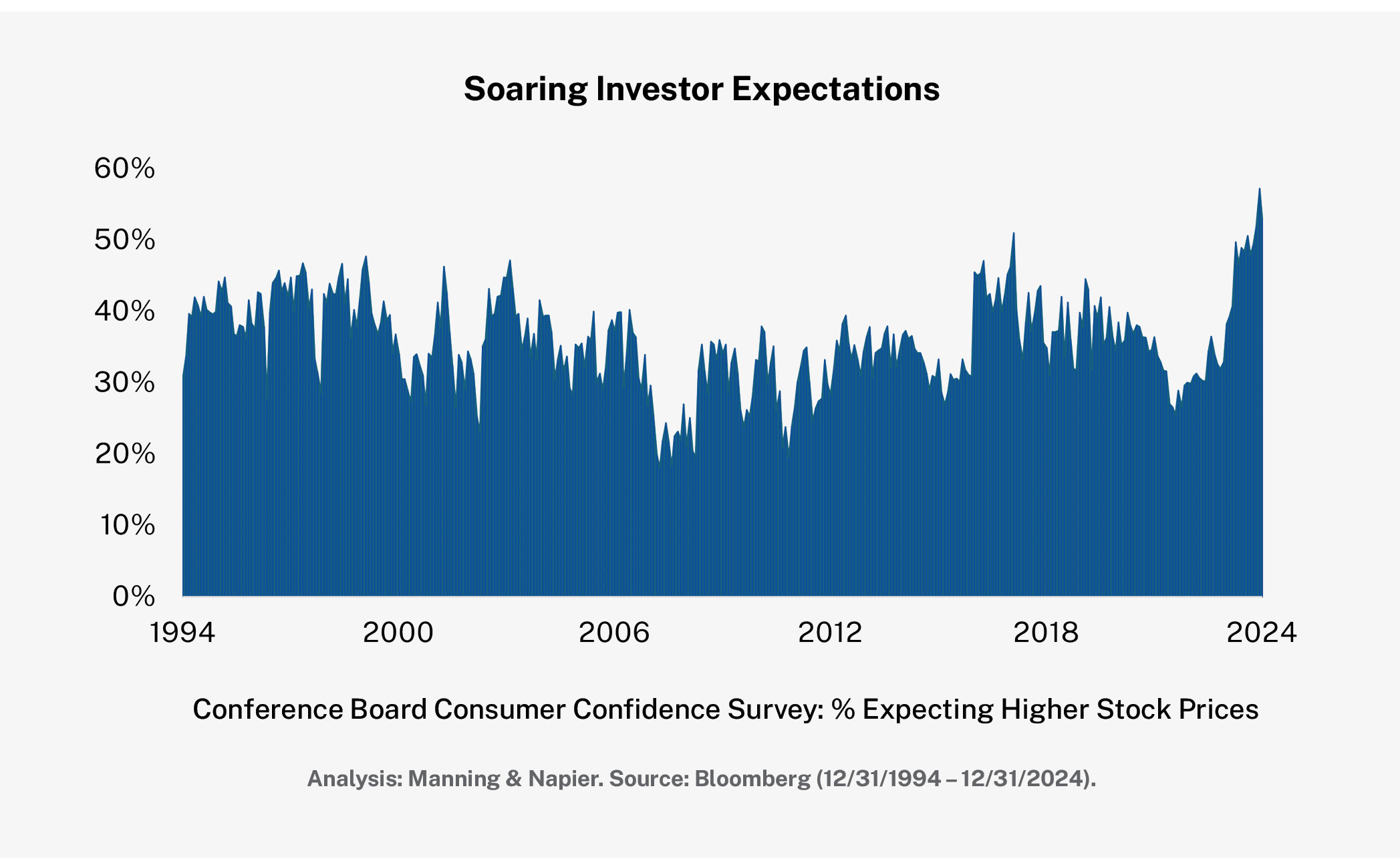

The S&P 500 begins 2025 at valuation levels that historically have proven challenging for long-term returns. Both the absolute and cyclically adjusted price-to-earnings ratio on the index are at levels that suggest long-term forward returns will be muted. Measures of investor sentiment from both pros and amateurs alike sit somewhere between very enthusiastic and downright exuberant. The major US indexes seem priced for perfection.

Of course, none of this means that the party has to end. These indicators are not deterministic. But there is no question that the balance between risk and reward in US equity markets seems skewed. Banking on continued multiple expansion to fuel further gains in the broad market feels an awful lot like swimming upstream.

Fortunately, the 2025 equity investment outlook does not end here. The narrow market leadership of 2024 means that many areas of the market have been left on the sidelines. Historically wide valuation gaps between US large cap stocks and most other investment styles such as international, small cap, and value stocks cannot persist forever. Investment approaches such as ours with the ability to identify attractive opportunities beyond the handful of stocks that won 2024’s popularity contest, may offer investors the ability to seek out opportunity while managing risk in the years ahead.

The Market: Fixed Income

Tail Risk (and Reward)

―

The bell curve, or normal distribution, is one of the most fundamental concepts taught in an introductory undergraduate statistics course. A key feature of the bell curve is that the most likely outcome occurs around the population average while the chance of extreme outcomes, which fall in the tails of the distribution, is exceedingly low. While this distribution has been used to approximate the behavior of financial markets, the reality is that extreme tail events occur far more often than the statistics indicate. We believe this risk is especially acute in the bond markets heading into 2025 due to the wide range of economic outcomes we discussed. Given this uncertainty, we are choosing our exposures carefully while looking for attractive opportunities to take on additional credit and duration within our bond portfolios in 2025.

Key takeaways:

- The futures market expects another 0.5% of rate cuts by the Fed in 2025. This should not be construed to mean that all market participants expect this outcome. Rather, it is a mix of potentially wildly divergent views ranging from outright hikes to several whole points of cuts.

- Rate volatility could be a defining aspect of the bond markets in 2025. If increased volatility is realized, it may open up opportunities to take advantage of dislocations across the entire fixed income universe.

Our fixed income outlook sees an end to the soft landing the economy experienced in 2023 and 2024. Markets, conversely, see a continuation of the soft landing without an end to the runway. There is limited price action in fixed income markets demonstrating risks to either upside or downside scenarios. In our view, the probability distribution for the economy and financial markets is bifurcated with fat tails on either side of the distribution.

Given that financial conditions remain easy, the last leg for inflation to come down to the Fed’s 2% target may prove difficult if a 4.25-4.5% policy rate is not as restrictive as many members on the Federal Open Market Committee (FOMC) believe. There is a material chance the Fed will need to pivot away from easing monetary policy and may even be forced to contemplate a hike in the policy rate by the end of 2025.

In assessing the attractiveness of interest rates through our valuation and conditions framework, we see attractive valuations with uncertain conditions. The attractiveness within nominal interest rates is underpinned by multi-cycle highs in real interest rates (i.e., nominal interest rates less inflation expectations). These factors inform our fixed income positioning which has overall interest rate sensitivity (duration) in line with that of the broader bond market.

Nowhere is the soft landing more priced in than in the corporate bond market. Spreads are near all-time lows as investors have piled into credit simply looking for returns. Fundamentals for corporate borrowers look fine in the rearview mirror but potential for spread tightening and an improvement in corporate fundamentals is extremely limited.

We are still finding value in securitized credit, and mortgage-backed securities (MBS) are looking attractive for the first time in a while. The securitized market is allowing us to find value in higher-rated bonds with cashflows secured by high-quality assets that offer adequate spread and carry for investors willing to take on some illiquidity premium. Meanwhile MBS market dynamics have resulted in yield-to-worst numbers that are competitive with investment-grade corporate bonds.

Tying it All Together

―

The year ahead will require strategic selectivity. As we continue to monitor trends in the economy and identify opportunities in markets, our outlook will evolve. That’s our job—to actively manage your portfolio as the environment changes. Uncertainty plays an element each and every year, that’s why working with an advisor to navigate changes will keep you focused on what you can control. From retirement goals and charitable giving to life changes and tax management, your financial plan centers you on a path to help continue building, growing, and sharing your wealth—amidst the changes in the economy and markets.

Managing your wealth is a continuous process. There’s always some degree of planning, updating, or reviewing to be done. With guidance from your financial consultant, you’ll be able to focus on the areas that will help make the most impact to your plan in the year ahead. As you have those conversations, keep the following in mind:

- Complete the financial wellness checklist to help provide an accurate picture for how you’re starting the year.

- Begin conversations with your tax professional and financial consultant early in the year to have a pulse on your situation and what tactics and strategies are appropriate for your plan.

We're here to help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

We’ll also stress test your plan by running a thousand simulations based on return forecasts and risk expectations, providing you with a range of different outcomes. At the end of the trials, you will receive a probability of success for your plan.

Get started with a free consultationDon’t forget to register for our live virtual event on January 23rd at 12:00 PM ET where you’ll get to hear from our team directly on our outlook and strategies to help keep your wealth growing in 2025.

Analysis: Manning & Napier.

The data presented is for informational purposes only. It is not to be considered a specific stock recommendation.

Past performance does not guarantee future results. Performance for periods greater than one year is annualized. Please note that diversification does not assure a profit or protect against loss in a declining market.

All investments contain risk and may lose value. This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The S&P 500 Total Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees or expenses. The index accounts for the reinvestment of regular cash dividends, but not for the withholding of taxes. Index returns provided by Bloomberg.

The S&P 500 Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. Index data provided by Bloomberg. Index data referenced herein is the property of S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates (“S&P”) and/or its third party suppliers and has been licensed for use by Manning & Napier. S&P and its third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.